Mastering Event Budgeting: A Step-by-Step Guide

Planning a memorable event takes creativity, effort, and most importantly, a well-thought-out budget. Whether you're managing a small corporate seminar or a large-scale conference, mastering the art of event budgeting is the key to success. With a solid financial plan in place, you can keep your costs under control while delivering an unforgettable experience for attendees.

If you've been struggling to align your event's goals with financial parameters, this step-by-step guide will simplify the process. Read on to discover practical methods and proven strategies to optimize your event budget with confidence.

Understanding the Basics of Event Budgeting

Before we jump into the "how," let's take a moment to clarify the "what" and "why" of event budgeting.

What is Event Budgeting?

Event budgeting is the process of planning, organizing, and allocating financial resources to ensure every aspect of your event is well-funded. It involves forecasting expenses, estimating revenue (if applicable), and adjusting figures to meet the overall event objectives.

Why is Event Budgeting Crucial?

Accurate budgeting is essential because it determines the scope and scale of your event. Mismanaging your budget can result in overspending, last-minute sacrifices, or a subpar experience for attendees. On the other hand, a well-managed budget ensures financial efficiency, reduces stress, and allows your creativity to flourish.

Common Misconceptions

- "Event budgeting is just about cutting costs." Not true. It's about maximizing value while intelligently prioritizing where every dollar is spent.

- "You don’t need a budget for small events." Every event—no matter its size—benefits from a structured budget.

Setting Objectives and Parameters

To create a meaningful budget, it's essential to align your financial plan with the objectives of your event.

Aligning with Event Goals

Ask yourself:

- What is the primary goal of the event? (E.g., lead generation, brand awareness, or employee engagement.)

- What kind of experience do you want to provide to attendees? (Luxury? Practical? Virtual?)

- Are there revenue-generating opportunities? (E.g., ticket sales, sponsorships, or merchandise.)

Defining these goals first will help you determine how much to invest in various elements like venue, marketing, food, or entertainment.

Tips for Setting Financial Parameters

- Start With Your Top-Line Budget: How much do you have available to spend overall? Be realistic.

- Define Your Must-Haves and Nice-to-Haves: Break down your budget essentials versus areas where you have flexibility.

- Plan for Overruns: Always add a 5-10% contingency for unexpected costs.

Creating the Budget

Now that your objectives are clear, let's create your event budget from scratch.

Step-by-Step Guide to Building an Event Budget

List All Possible Expenses:

Categorize your expenses into major areas like:

- Venue rental

- Catering and beverages

- Audio-visual equipment

- Decorations and signage

- Entertainment and speakers

- Marketing and promotions

Estimate Costs:

Research average costs for each category, considering local vendors or available resources. Get multiple quotes when possible.

Identify Revenue Streams:

Consider ticket sales, sponsorships, or exhibitor fees as potential sources of income.

Create a Detailed Spreadsheet:

Use software or templates (Google Sheets, Excel, or budgeting apps) to track every expense and revenue source. For added efficiency, invest in tools like Planners Pro or Toggl.

Divide by Phases:

Break your budget into stages—pre-event, during the event, and post-event—to allocate resources more granularly.

Budgeting Tools & Templates

- Fekra Budget Planner (Exclusive to our clients!): A comprehensive Excel template designed to manage every element of your event's finances.

- Online tools like Budgeto or EventPro help automate event budgeting tasks.

Allocating Funds Effectively

After building your budget, it's time to think strategically about where and how funds should be allocated.

Strategies for Prioritizing Spending

- Invest in Experiences:

Focus on areas that directly impact attendee experience, like a welcoming venue, engaging speakers, or innovative tech.

- Trim Where Necessary:

Opt for digital invites over printed ones or consider hybrid events to reduce costs while expanding your reach.

- Negotiate with Vendors:

Don’t be afraid to discuss pricing or request bundled services. Most vendors value building long-term relationships over short-term profits.

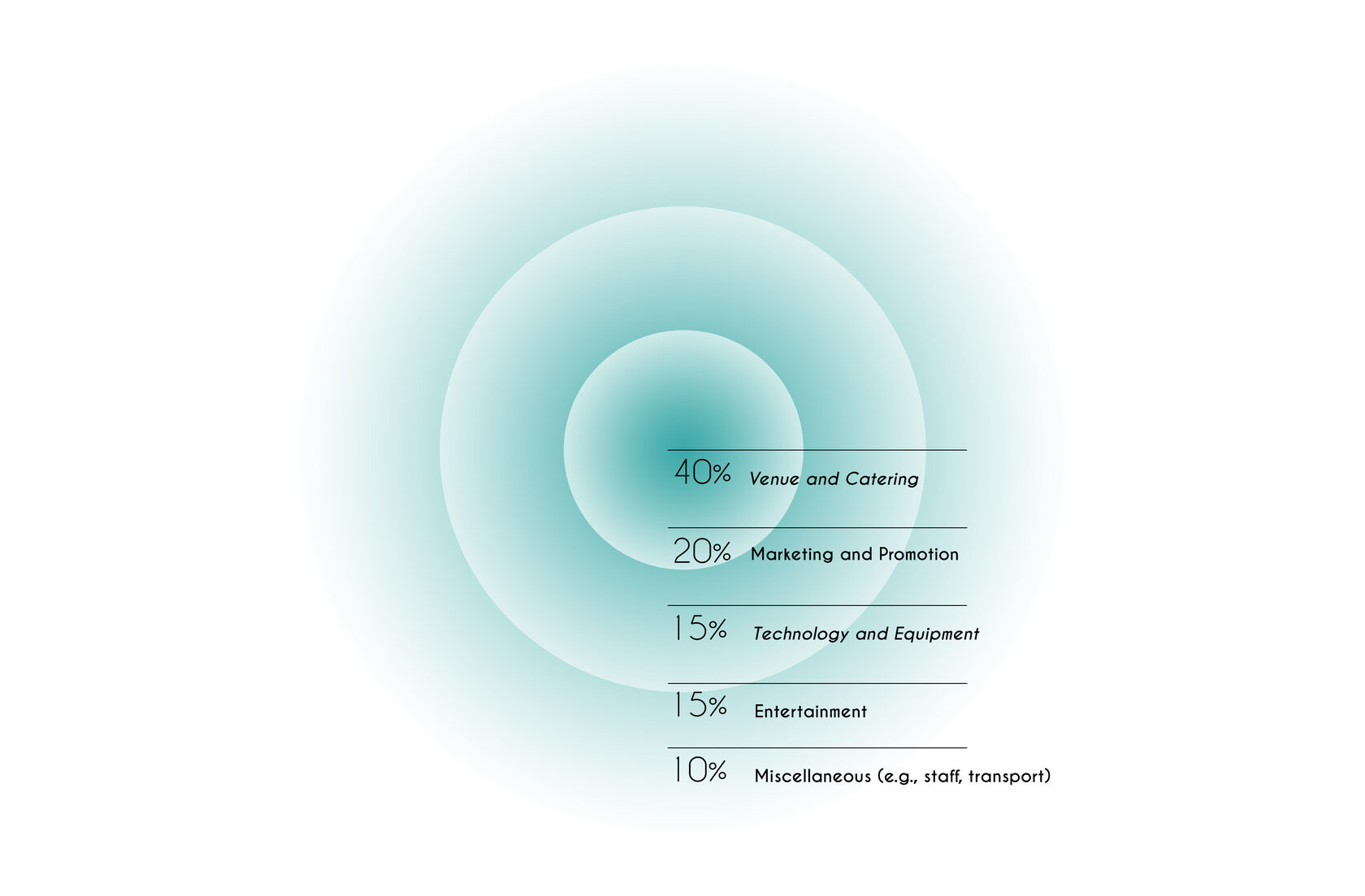

Key Allocation Areas

Monitoring and Adjusting the Budget

Even with the most meticulous planning, unforeseen expenses can arise. Monitoring your budget can help you adapt in real time.

Why Tracking Expenses Matters

Tracking allows you to:

- Identify areas where you're overspending.

- Adjust in-the-moment decisions to prevent going over budget.

- Ensure transparency for stakeholders.

How to Make Real-Time Adjustments

- Use budget trackers like Eventbrite or Cvent to synch spending in real-time.

- Prioritize revisiting your “Nice-to-Have” list if cuts need to be made.

Case Studies and Practical Examples

Example 1: A Corporate Conference with a $50k Budget

Challenge:

To host a professional yet engaging corporate event without overspending.

Solution:

- Focused on securing a mid-range venue and prioritized funding for high-profile keynote speakers.

- Used email marketing rather than paid ads to reduce promotional costs.

Result:

Achieved a 25% lead generation increase with costs under budget.

Example 2: Hybrid Startup Launch Event with $10k Budget

Challenge:

Limited budget for both physical and virtual attendees.

Solution:

- Chose a cozy, affordable venue while leveraging free social media channels for promotion.

- Partnered with local vendors for discounted catering options.

Result:

A highly engaging event with 40% customer acquisition while saving 15% from the overall budget.

Wrapping It Up with Confidence

Mastering event budgeting is more than crunching numbers—it's about aligning your financial plan with your event's goals, audience expectations, and brand values. By understanding your needs, setting clear parameters, and tracking spending, you’ll build not just better events but sustainable business success.

At Fekra Events, we pride ourselves on helping clients deliver extraordinary events without breaking the bank. Need help with planning or budgeting your next big event? Contact us today! We're here to make your vision a reality.